Does Pa Charge Sales Tax On Beer . Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web application of the tax. The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use tax. Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019.

from taxfoundation.org

Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use tax. Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. Web application of the tax. Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Pennsylvania's general sales tax of 6% also applies to the purchase of beer.

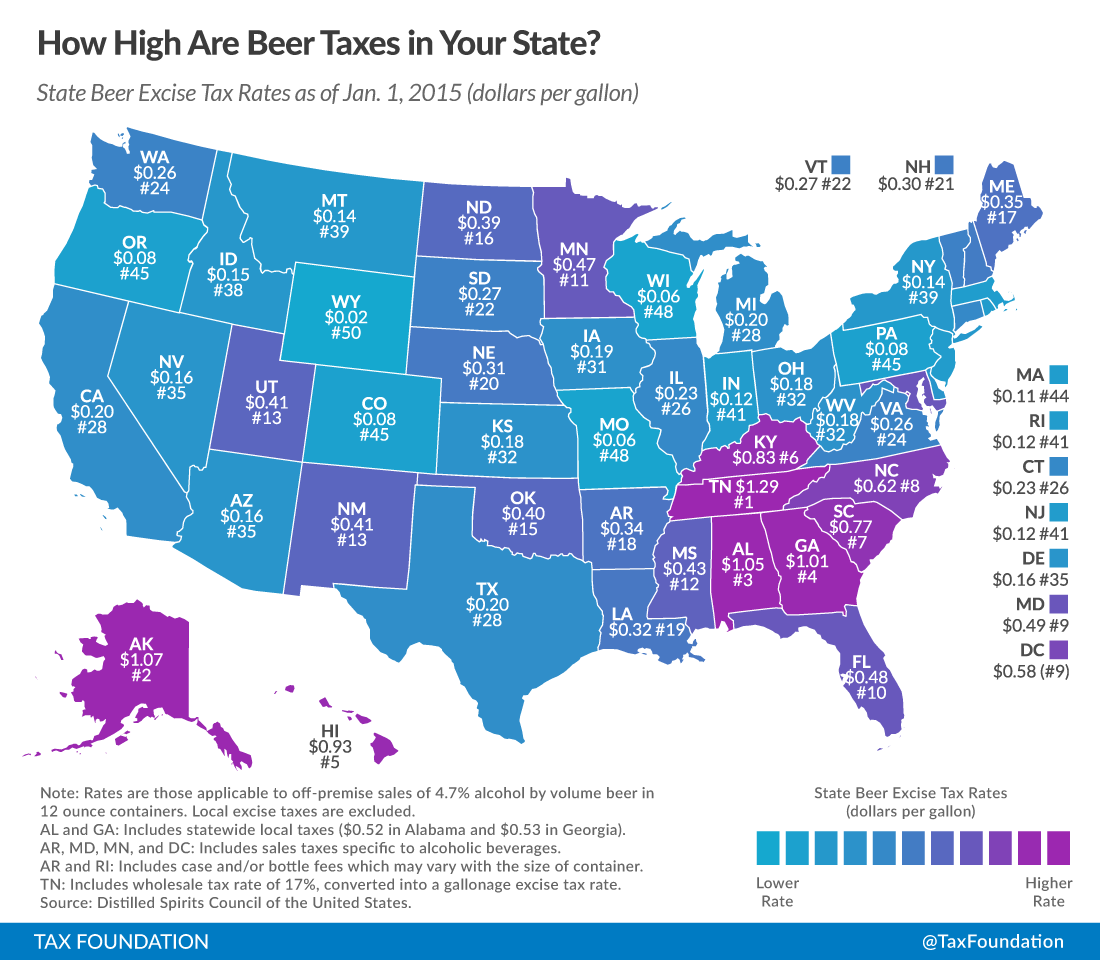

How High Are Beer Taxes in Your State? Tax Foundation

Does Pa Charge Sales Tax On Beer Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web application of the tax. Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use tax. Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on.

From taxfoundation.org

Beer Map How High are Beer Taxes in Your State? State Beer Map Does Pa Charge Sales Tax On Beer Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web application of the tax. Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use tax. Pennsylvania's general sales. Does Pa Charge Sales Tax On Beer.

From ceojyuje.blob.core.windows.net

Does Pa Charge Sales Tax On Towing at Kristy Breeden blog Does Pa Charge Sales Tax On Beer Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web a bottle shop pays *a* sales tax. Does Pa Charge Sales Tax On Beer.

From vinepair.com

These 3 Maps Show The States That Charge The Most Tax On Beer, Wine Does Pa Charge Sales Tax On Beer Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web for establishments who manufacture their own malt or brewed beverages, such as breweries,. Does Pa Charge Sales Tax On Beer.

From api.minibrew.io

How much is a pint of beer? The beer guide on how much a glass of beer Does Pa Charge Sales Tax On Beer Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. The following examples. Does Pa Charge Sales Tax On Beer.

From cedawuyj.blob.core.windows.net

What Does Pa Charge Sales Tax On at Linda Wood blog Does Pa Charge Sales Tax On Beer Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use. Does Pa Charge Sales Tax On Beer.

From www.businessinsider.com

US Taxes On Beer, Wine, And Spirits [MAPS] Business Insider Does Pa Charge Sales Tax On Beer Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web application of the tax. Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019.. Does Pa Charge Sales Tax On Beer.

From finance.townhall.com

Beer Taxes By State Political Calculations Does Pa Charge Sales Tax On Beer Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Web application of the tax. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. The following examples demonstrate how a manufacturer must either charge and remit sales. Does Pa Charge Sales Tax On Beer.

From www.salestaxsolutions.us

Sales Tax Pennsylvania State of Pennsylvania Sales and Use Tax Does Pa Charge Sales Tax On Beer Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. Web application of the tax. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web a bottle shop pays *a* sales tax when they buy from. Does Pa Charge Sales Tax On Beer.

From ceojyuje.blob.core.windows.net

Does Pa Charge Sales Tax On Towing at Kristy Breeden blog Does Pa Charge Sales Tax On Beer The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use tax. Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web in october, the pennsylvania department of revenue released a sales tax bulletin that. Does Pa Charge Sales Tax On Beer.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Does Pa Charge Sales Tax On Beer Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate. Does Pa Charge Sales Tax On Beer.

From brewpublic.com

Beer Federal Excise Tax Rates Extended Through 2020 Does Pa Charge Sales Tax On Beer Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web application of the tax. Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Pennsylvania's general sales tax of 6% also applies to the purchase of beer.. Does Pa Charge Sales Tax On Beer.

From cedawuyj.blob.core.windows.net

What Does Pa Charge Sales Tax On at Linda Wood blog Does Pa Charge Sales Tax On Beer Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web. Does Pa Charge Sales Tax On Beer.

From taxfoundation.org

Beer Taxes in Your State 2019 State Beer Tax Rankings Does Pa Charge Sales Tax On Beer Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web application of the tax. Web the law imposes a use tax on manufacturers for any malt or brewed beverages. Does Pa Charge Sales Tax On Beer.

From taxfoundation.org

Monday Map State Beer Excise Tax Rates Tax Foundation Does Pa Charge Sales Tax On Beer Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web application of the tax. Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web in october, the pennsylvania department of revenue released. Does Pa Charge Sales Tax On Beer.

From ceojyuje.blob.core.windows.net

Does Pa Charge Sales Tax On Towing at Kristy Breeden blog Does Pa Charge Sales Tax On Beer Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. Web for establishments who manufacture their. Does Pa Charge Sales Tax On Beer.

From cedawuyj.blob.core.windows.net

What Does Pa Charge Sales Tax On at Linda Wood blog Does Pa Charge Sales Tax On Beer Web no, excluded from sales tax are those sales by retail dispensers & plcb licensees. Web application of the tax. Pennsylvania's general sales tax of 6% also applies to the purchase of beer. Web in october, the pennsylvania department of revenue released a sales tax bulletin that explains how the sales tax. Web the law imposes a use tax on. Does Pa Charge Sales Tax On Beer.

From blog.accountingprose.com

Pennsylvania Sales Tax Guide Does Pa Charge Sales Tax On Beer Web a bottle shop pays *a* sales tax when they buy from a distributor (usually at a wholesale price, but not always). Web the law imposes a use tax on manufacturers for any malt or brewed beverages sold directly to the ultimate consumer for consumption on. Web in october, the pennsylvania department of revenue released a sales tax bulletin that. Does Pa Charge Sales Tax On Beer.

From www.dontwasteyourmoney.com

This map shows how high beer taxes are in every state Does Pa Charge Sales Tax On Beer Web for establishments who manufacture their own malt or brewed beverages, such as breweries, act 13 of 2019. Pennsylvania's general sales tax of 6% also applies to the purchase of beer. The following examples demonstrate how a manufacturer must either charge and remit sales tax or pay use tax. Web no, excluded from sales tax are those sales by retail. Does Pa Charge Sales Tax On Beer.