What Services Are Subject To Sales Tax In Ny . In addition, some services are only subject to new. — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. While new york's sales tax generally applies to most transactions, certain items have special. — many services are subject to new york’s 4% sales tax rate: The taxability of various transactions (like services and shipping) can vary from. are services subject to sales tax? this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. — the tax law exempts purchases for resale; Most sales to or by the federal and new york state governments,. what purchases are taxable in new york? — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses.

from www.youtube.com

While new york's sales tax generally applies to most transactions, certain items have special. The taxability of various transactions (like services and shipping) can vary from. what purchases are taxable in new york? — many services are subject to new york’s 4% sales tax rate: Most sales to or by the federal and new york state governments,. are services subject to sales tax? this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. In addition, some services are only subject to new.

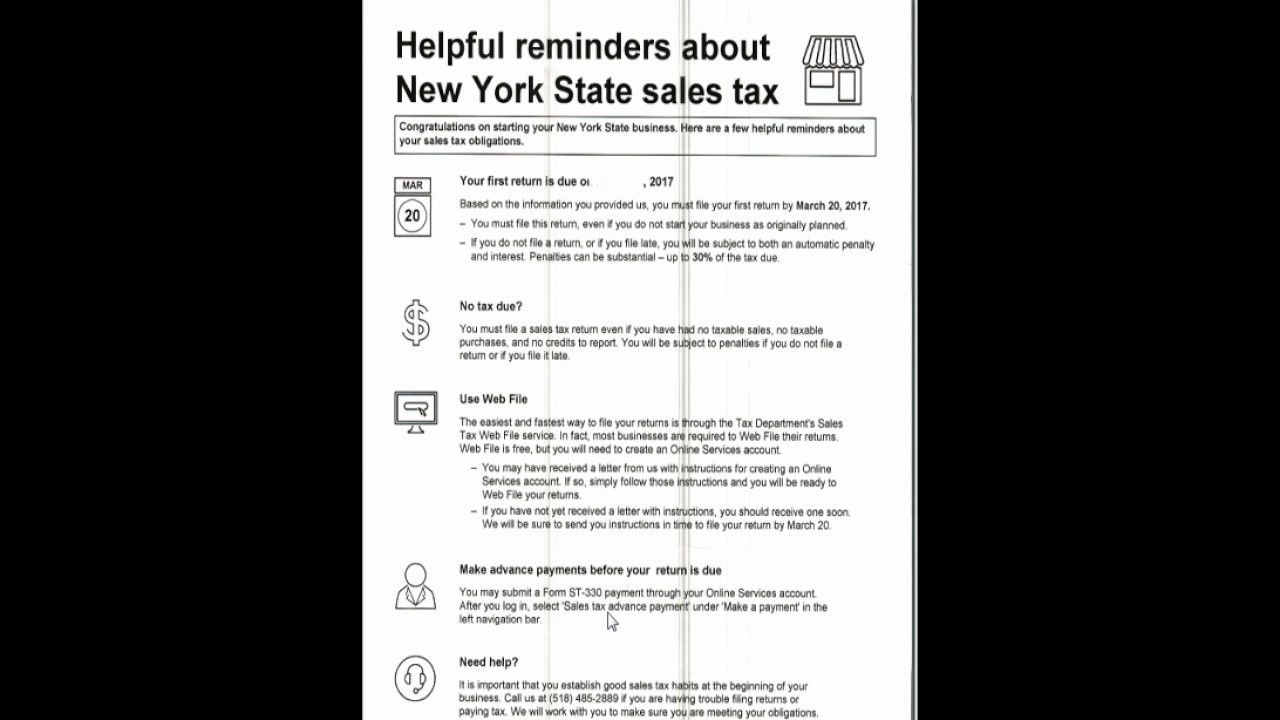

NY SALES TAX WEB FILE YouTube

What Services Are Subject To Sales Tax In Ny In addition, some services are only subject to new. — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. While new york's sales tax generally applies to most transactions, certain items have special. are services subject to sales tax? — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. In addition, some services are only subject to new. what purchases are taxable in new york? — the tax law exempts purchases for resale; — many services are subject to new york’s 4% sales tax rate: Most sales to or by the federal and new york state governments,. The taxability of various transactions (like services and shipping) can vary from. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable.

From blanker.org

Form DR15. Sales and Use Tax Return Forms Docs 2023 What Services Are Subject To Sales Tax In Ny The taxability of various transactions (like services and shipping) can vary from. Most sales to or by the federal and new york state governments,. — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. — many services are subject to new york’s 4% sales tax rate: — the tax. What Services Are Subject To Sales Tax In Ny.

From twitter.com

Tax Scan on Twitter "https//taxscan.in/servicetaxonoverriding What Services Are Subject To Sales Tax In Ny Most sales to or by the federal and new york state governments,. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. In addition, some services are only subject to new. The taxability of various transactions (like services and shipping) can vary from. While new york's sales tax. What Services Are Subject To Sales Tax In Ny.

From howtostartanllc.com

New Jersey Sales Tax Small Business Guide TRUiC What Services Are Subject To Sales Tax In Ny — many services are subject to new york’s 4% sales tax rate: In addition, some services are only subject to new. — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. — the tax law exempts purchases for resale; The taxability of various transactions (like services and shipping) can. What Services Are Subject To Sales Tax In Ny.

From stepbystepbusiness.com

New York Sales Tax Calculator What Services Are Subject To Sales Tax In Ny Most sales to or by the federal and new york state governments,. what purchases are taxable in new york? In addition, some services are only subject to new. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. — sales of tangible personal property are subject. What Services Are Subject To Sales Tax In Ny.

From www.taxuni.com

New York Sales Tax 2024 What Services Are Subject To Sales Tax In Ny this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. Most sales to or by the federal and new york state governments,. are services subject to sales tax? — this publication is a comprehensive guide to new york state and local sales and use taxes for. What Services Are Subject To Sales Tax In Ny.

From taxorganization.org

What is Base Broadening Tax organization What Services Are Subject To Sales Tax In Ny what purchases are taxable in new york? — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. Most sales to or by the federal and new york state governments,. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that. What Services Are Subject To Sales Tax In Ny.

From www.zrivo.com

New York Sales Tax 2024 What Services Are Subject To Sales Tax In Ny — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. are services subject to sales tax? — many services are subject to new york’s 4% sales tax rate: In addition, some services are only subject to new. — sales of tangible personal property are subject to new. What Services Are Subject To Sales Tax In Ny.

From www.youtube.com

If I Don't Have Anything Subject to NY Sales Tax, How Does a Sales Tax What Services Are Subject To Sales Tax In Ny what purchases are taxable in new york? — many services are subject to new york’s 4% sales tax rate: In addition, some services are only subject to new. — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. this publication is a comprehensive guide to new york. What Services Are Subject To Sales Tax In Ny.

From www.tripsavvy.com

A Shoppers' Guide To New York City Sales Tax What Services Are Subject To Sales Tax In Ny In addition, some services are only subject to new. The taxability of various transactions (like services and shipping) can vary from. are services subject to sales tax? — the tax law exempts purchases for resale; — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. — sales. What Services Are Subject To Sales Tax In Ny.

From www.taxtools.com

NY Sales Tax Preparer CFS Tax Software, Inc. Software for Tax What Services Are Subject To Sales Tax In Ny — many services are subject to new york’s 4% sales tax rate: — the tax law exempts purchases for resale; this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. what purchases are taxable in new york? — this publication is a comprehensive guide. What Services Are Subject To Sales Tax In Ny.

From spectrumnews1.com

New services subject to sales tax What Services Are Subject To Sales Tax In Ny In addition, some services are only subject to new. While new york's sales tax generally applies to most transactions, certain items have special. what purchases are taxable in new york? The taxability of various transactions (like services and shipping) can vary from. Most sales to or by the federal and new york state governments,. — the tax law. What Services Are Subject To Sales Tax In Ny.

From blog.accountingprose.com

New York Sales Tax Guide What Services Are Subject To Sales Tax In Ny — this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. are services subject to sales tax? The taxability of various transactions (like services and shipping) can vary. What Services Are Subject To Sales Tax In Ny.

From news.wbfo.org

With red flag raised on New York’s sales tax revenue, economists What Services Are Subject To Sales Tax In Ny are services subject to sales tax? Most sales to or by the federal and new york state governments,. — many services are subject to new york’s 4% sales tax rate: While new york's sales tax generally applies to most transactions, certain items have special. what purchases are taxable in new york? — sales of tangible personal. What Services Are Subject To Sales Tax In Ny.

From dxolfranm.blob.core.windows.net

What Is The Sales Tax On Alcohol In New York at Joseph Neal blog What Services Are Subject To Sales Tax In Ny Most sales to or by the federal and new york state governments,. While new york's sales tax generally applies to most transactions, certain items have special. In addition, some services are only subject to new. — many services are subject to new york’s 4% sales tax rate: The taxability of various transactions (like services and shipping) can vary from.. What Services Are Subject To Sales Tax In Ny.

From old.ageras.com

Discover Which Services are Subject To Sales Tax Ageras What Services Are Subject To Sales Tax In Ny — the tax law exempts purchases for resale; Most sales to or by the federal and new york state governments,. what purchases are taxable in new york? While new york's sales tax generally applies to most transactions, certain items have special. — many services are subject to new york’s 4% sales tax rate: — sales of. What Services Are Subject To Sales Tax In Ny.

From www.cpapracticeadvisor.com

6 Types of Services Subject to Sales Tax CPA Practice Advisor What Services Are Subject To Sales Tax In Ny While new york's sales tax generally applies to most transactions, certain items have special. — many services are subject to new york’s 4% sales tax rate: Most sales to or by the federal and new york state governments,. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell. What Services Are Subject To Sales Tax In Ny.

From www.patriotsoftware.com

How to Pay Sales Tax for Small Business Guide + Chart What Services Are Subject To Sales Tax In Ny The taxability of various transactions (like services and shipping) can vary from. — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. Most sales to or by the federal. What Services Are Subject To Sales Tax In Ny.

From gamma.app

A Comprehensive Guide to Taxation for Business Owners What Services Are Subject To Sales Tax In Ny this publication is a comprehensive guide to new york state and local sales and use taxes for businesses that sell taxable. — the tax law exempts purchases for resale; — sales of tangible personal property are subject to new york sales tax unless they are specifically exempt. are services subject to sales tax? Most sales to. What Services Are Subject To Sales Tax In Ny.